AccessPay: A Corporate to Bank Payments Connectivity Platform

AccessPay

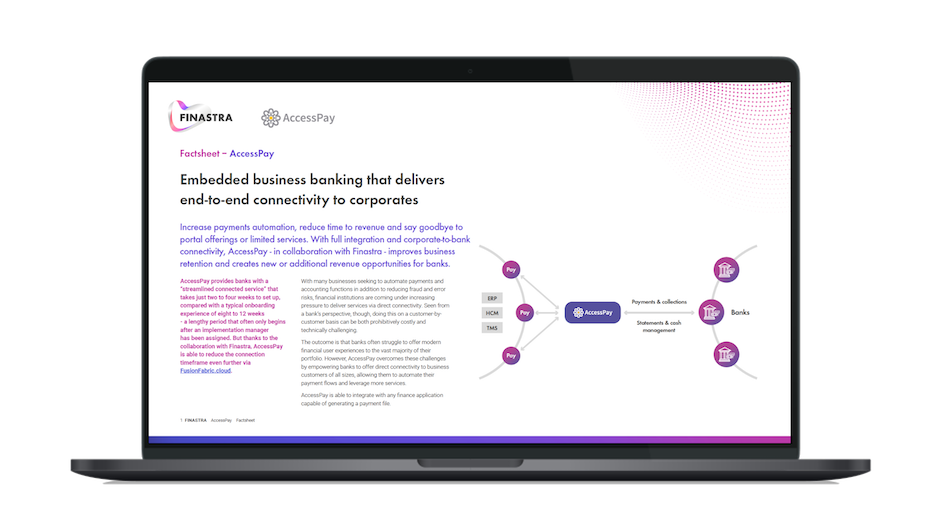

AccessPay and Fusion Global PAYplus addresses end to end bank to corporate ERP connectivity, delivering embedded banking for the corporate. It enables banks to offer direct integration to a wider corporate audience by addressing the speed to set up the initial connection at the bank via FusionFabric.cloud, solving the corporate challenges of creating and maintaining the correct payment file types for the bank.

Corporate customers are looking to direct bank connectivity to enable them to automate their payment flows, reduce risk and increase efficiency in their treasury and finance operations. They are exploring open banking and alternative solutions in the market. To face these alternatives, banks need to improve the customer experience and deliver more valuable services, while keeping the costs low.

Onboarding speed and scale

Direct ERP connectivity is expensive to resource, costly to maintain (as file standards for all payment types across multi-banks is difficult) and takes time to deploy at scale. Hence, banks can offer this to <10% of corporates. Using a fully managed service to quickly connect all customers and overcome the cost and time barrier, to onboard even smaller customers, by offering direct connection for all payments types (payroll, collections, supplier) to ERP systems, in their native formats, transformed and enriched through a single “always on” managed platform, fully supported by industry professionals.

Competitive service and costs

By automating the payment process on both sides, reducing operational costs and risk for both bank and corporate finance teams with fully automated, flexible approval flows. Files sent from corporate in ERP format guarantees bank ready files every time, reducing maintenance and service issues, resulting in a highly competitive service, sticky to corporate customers.

Future proofing further service offerings

Potential to offer new financial services of automating payments from ERP to the bank (such as Trade Finance, Data analysis) across one platform on the latest technology without having to increase resource or technology/ infrastructure systems.

General information

How it works

Call payment initiation API

The solution connects to an existing finance system, consumes payment files generated by that system, and transforms them into a bank ready file.Processing the payment

The solution performs a series of validation checks automatically, notifying users of anything that needs to be reviewed.Generate payment status

Payment status is sent in real time to all the corporates.

How it looks

Submitter dashboard

See the history of all recent submissions and get a quick overview of the next actions, status and payment cancellations or failures. Show lessSubmission – routing and validation

The payment files are automatically checked and routed. Get notifications on potential errors, analyze them, and proceed accordingly. Show lessSubmission - Approval

Payment transactions may flow be scheduled and flow automatically, straight through processing, or may have singular or multi-level approval based on rules set by you. Select payment date and proceed with the payments. You receive automated notification for actions even when not in the system. Show less