ComplyAdvantage

ComplyAdvantage

ComplyAdvantage is a transaction screening and monitoring solution based on real-time anti-money laundering data. It helps financial institutions screen, detect, and mitigate anti-money laundering risk. ComplyAdvantage screens parts of the payment against real-time sanctions data and configure rules and policies to quickly review and release transactions, streamlining compliance obligations.

Regulatory bodies often release new guidance for anti-money laundering compliance. This means financial institutions must stay ahead to avoid non-compliance, as it is considered one of the top drivers for enforcing actions and fines. Using legacy solutions can lead to unmanageable alert backlogs and large numbers of false positives, putting the entire compliance program at risk. In addition, customers expect their transactions to be processed without delays. To improve the customer experience financial institutions are moving towards real-time, integrated solutions. This speeds up alert remediation and reduces unnecessary payment delays.

Automated data generation

ComplyAdvantage uses machine learning to ensure that data is relevant, up to date and accurate, providing Financial Institutions a solution that is constantly improved.

Powerful search algorithm

The algorithm is configured to a risk-based approach and AI/ML-powered, empowering compliance professionals to act precisely, improving efficiency.

Automated ongoing monitoring with full audit trail

Capture and produce an audit trail of decisions made quickly and efficiently.

General information

How it works

Configure monitoring

Define scenarios and apply to customer/transaction segments. The ComplyAdvantage implementation team is dedicated to support and guidance on best practices.Send data

The data model is agnostic, data is sent via REST APIs or batch file upload.Manage alerts and performance

Identify and react to suspect behaviors in real-time or retrospectively, analyze with efficacity and then download and submit internal and regulatory reports.Response in real-time

Using the REST APIs or webhooks.

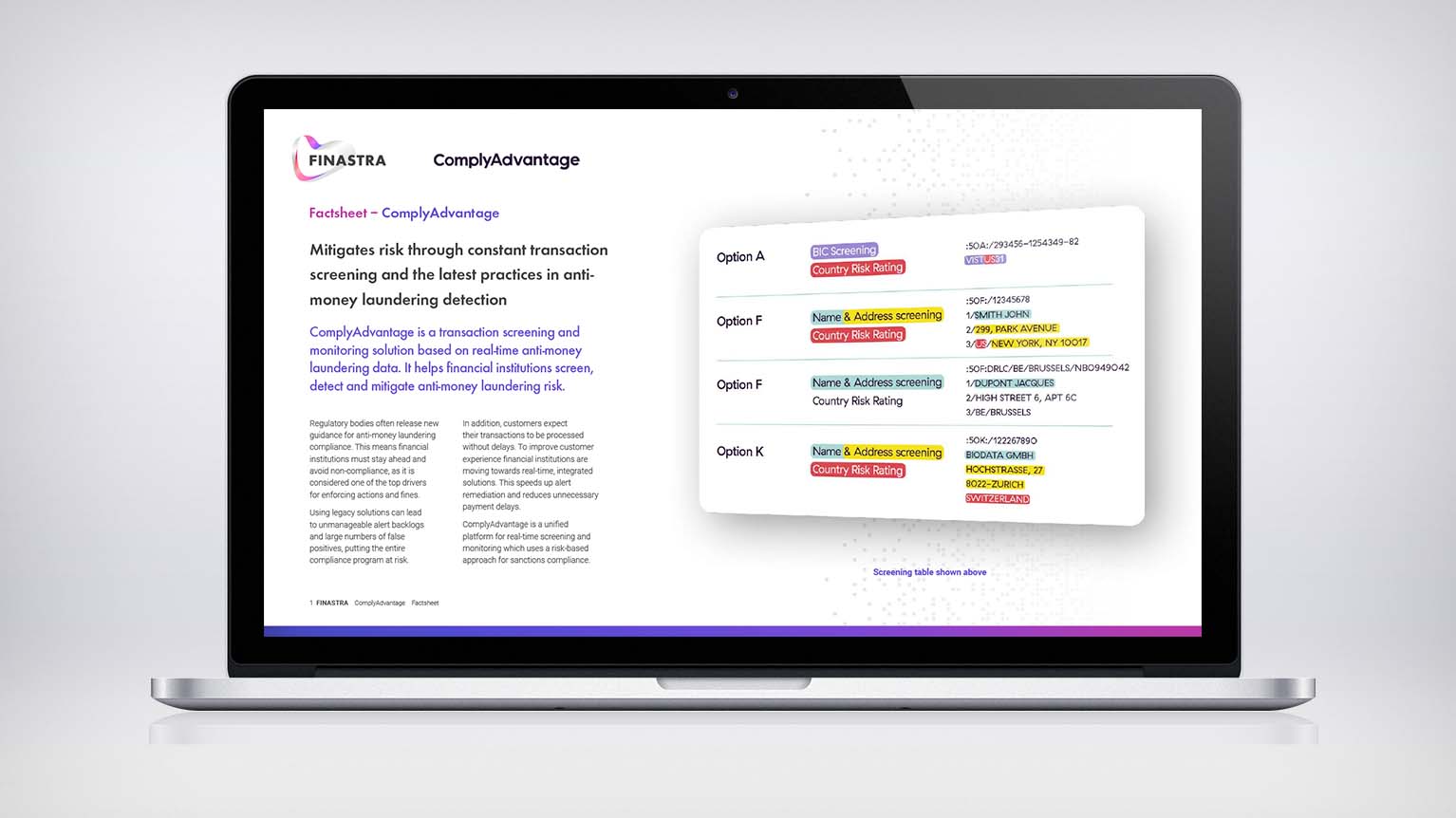

How it looks

Case management

Unique capability of monitoring hundreds of interdependent sanctions lists concurrently in real-time. Show lessConfigure flexible rules and policies to your risk-based approach

Run separate rules on each field of a payment message along with list type and fuzziness levels. Show lessUser profile

Screens and monitors transactions against the latest sanctions and watchlist data. Show less