Earned Wage Access Solution for Banks

PayKey (Decentralized Mobile Applications Ltd.)

PayKey’s Earned Wage Access (EWA) solution strengthens banks’ relationships with employees by offering on-demand access to earned wages before payday, enabling greater liquidity and financial resilience. The end-to-end white labelled solution for banks has no effect on employers’ balance sheets or payroll cycles, serving as a key employment benefit for employees of all industries.

Earned Wage Access is a huge industry currently “owned” by Fintechs . In the U.S. alone the industry was valued at $9Bn in 2020 with expected growth in coming years according to research by Aite group. Financial health is a key growth strategy for banks: realizing the benefits of financial wellbeing on employee’s overall wellness, productivity, and stability. Banks are increasingly introducing tools for financial wellness to cultivate long-term relationships and ultimate customer LTV growth. Driven by the gig economy, consumers are demanding instant access to income: according to PaymentsSource over half of U.S. employees are interested in Earned Wage Access or are already using such solutions.

A unique proposition for banks

PayKey’s EWA solution provides banks the ability to tap into the Earned Wage Access industry with a fully white-labeled solution. While other EWA solutions are currently offered directly to employees and employers by fintechs, PayKey provides a dedicated solution for banks that generates new revenues and drives stickiness with the bank’s services.

An end-to-end solution white-labeled for banks

An end-to-end solution white-labeled for banks. The solution seamlessly connects the bank to all relevant HR and Human Capital Management systems to facilitate full EWA flow, requiring simple plug-and-play integration and no maintenance by the bank. It transforms HR data into financial data, based on unique customer profile.

Providing a proprietary HR-based risk engine

The solution augments the banks’ financial data with additional HR indicators to formulate comprehensive consumer profiles. This keeps the bank’s risk at a minimum while enabling high-intent loan and savings offers, personalized for the customers’ needs, to overcome the struggle to stay relevant and attract customers.

General information

How it works

Help your employees

PayKey provides an end-to-end white label solution enabling financial institutions to provide employees instant early access to their already worked and earned wages, before payday.Expand your customer base

With a single SDK integration, the bank will be able to provide these services to its existing customers and new ones.An adaptative application

PayKey connects to any HR and payroll system to validate employees’ details and withdrawal request. It facilitates the EWA transaction for the employee upon request throughout the month and facilitates the repayment on payday.Upgrade your customer experience

The EWA platform allows the bank to offer additional financial services (loans, savings) as well as personalized offers, based on PayKey’s proprietary HR-based risk engine.

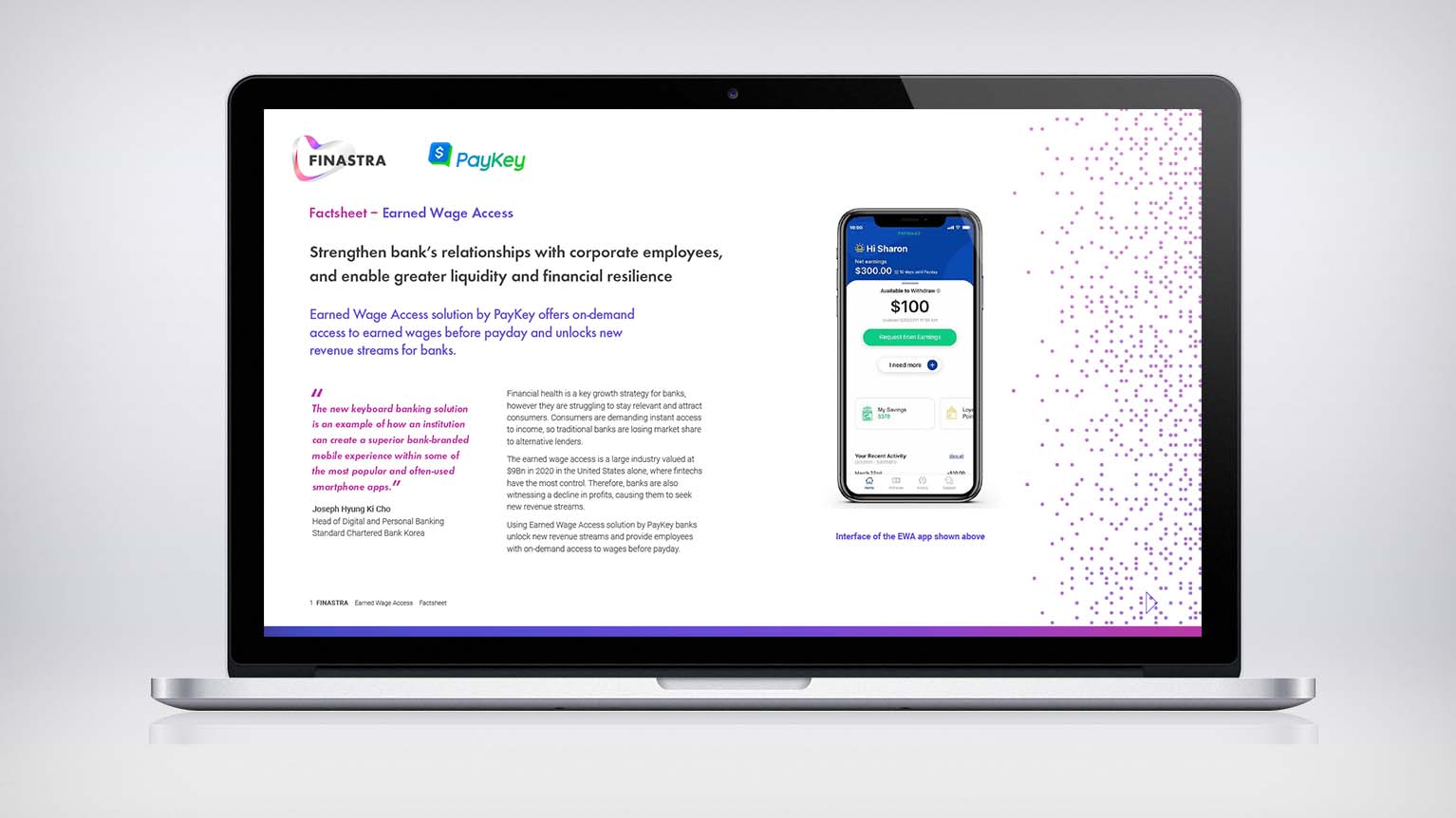

How it looks

Help your clients achieve their goals

Allow them to understand how much they can save based on their habits and offer a simple way to set this money aside. Show lessMaking banks the gateway for income management

PayKey allows banks to empower the employees of its corporate customers with on-demand early access to earned wages, unlocking new revenue streams while growing revenue per user by up to 15%. Show lessHelp your customer manage their finances

Typically offered through employers by a third-party provider, as part of workplace benefits package, the solution offers the customers a quick view of their financial status. Show less

Help your clients achieve their goals

Allow them to understand how much they can save based on their habits and offer a simple way to set this money aside. Videos

Resources