Pipit

Pipit Global

Pipit Global gives consumers the ability to pay for goods and services without the need to have a bank account where they live. It enables migrants and foreign workers who are unbanked where they live, to transact internationally, digitally and online with cash and lodge cash to their home account. Pipit Global offers the unbanked an online platform to receive cash and make payments for their bills hence opens the cash market for merchants, not just domestically but globally.

70% of the global remittance market goes from ‘developed nations’ to ‘developing nations’, with an average of €200 a month per migrant. As emerging banks don’t have international branches, they are not able to provide access to those migrants who then need to use branded cash transfer companies that charge up to 12%. Using Pipit Global allows cost savings for the customer and useful analytics for the banks, potentially creating revenues by upselling loans and other services.

One single account

With Pipit, migrants can lodge cash to their bank accounts without needing a bank account where they live. This solves the problem for migrants of the expense of sending cash home.

Branch extension

By having access to our global collection network through an integration to the bank's platform, customers living outside of the bank’s origin country can deposit funds though our network straight to their bank accounts back in their home country.

Financial inclusion

Banks in emerging markets are driving financial Inclusion campaigns and value the importance of financial inclusion to their economies and societies. Pipit can help banks make a significative social impact.

General information

How it works

Step 1

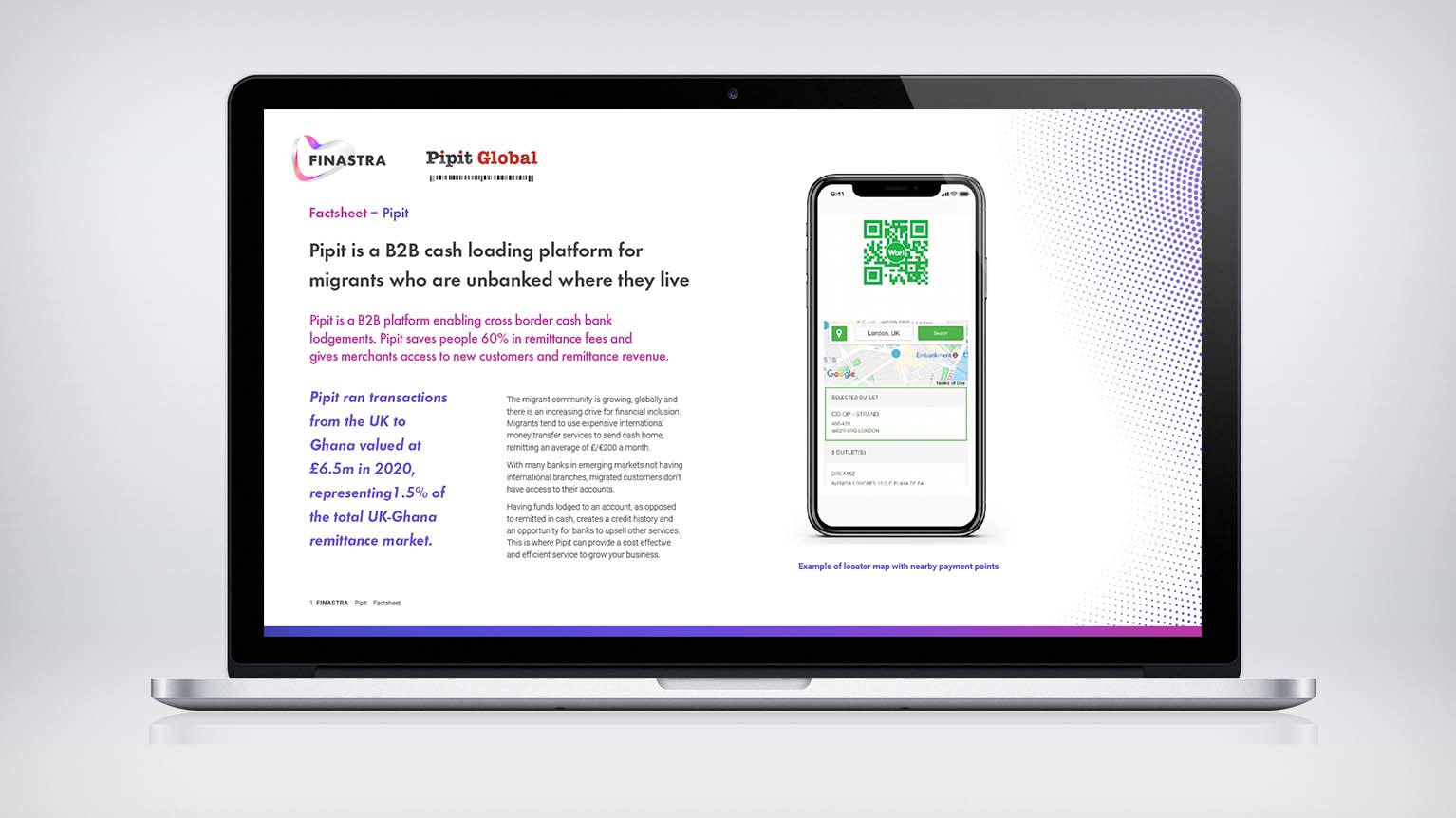

The bank customer logs into their bank APP / mobile banking page.Step 2

They select the option to lodge cash to their account.Step 3

They select Pipit and a barcode is generated and issued in the APP or sent by email from the mobile banking page.Step 4

The customer is geolocated and directed to the nearest agent, next they simply bring this barcode to any Pipit collection partner where it is scanned and lodges the cash over the counter or at a kiosk.Step 5

Once the barcode is scanned, Pipit notifies the bank to credit the relevant account with the lodged amount within 15 min, the account is credited in local currency the same day.

How it looks

Setting up the transaction

Enter the destination bank account number, the amount to be lodged, the customer’s email address and phone number, as well as the currency, then click on “create deposit”. Show less