IDCheck.io

ARIADNEXT

Use IDCheck.io by ARIADNEXT by IDnow to fight against fraud, be compliant with all regulations and propose an outstanding customer experience. IDCheck.io enables financial actors to be compliant with AML regulations by performing Identity verification in real time. IDCheck.io is faster and more reliable in terms of fraud prevention than any other identity verification solution on the market.

Regulators are often changing their obligations so Financial Institutions must constantly change their processes. Moreover, Financial Institutions face huge costs due to fraud and breaches in the process of identifying their end-customers, but they must still propose competitive and high standard onboarding processes to their end-customers. All this leads to a necessity for automation and decreasing costs.

Compliance

Financial Institutions must perform due diligence for the bank account opening process and face a huge fine if they don’t use a solution that is compliant with every country regulator in Europe.

Fight against fraud

Fraud has a huge impact on customer running costs. More than financial aspects, the misuse of false identities by the end-customers can have legal implications or lead to a breach in security processes. ARIADNEXT by IDnow detects more fraud than its competitors thanks to AI machine learning and regularly assesses large sets of documents to better detect fraud.

User experience

Financial Institutions need to propose the best UX to their end-customers, so they limit churn and/or end-customers abandoning the onboarding process. IDCheck.io provides a 5-minute end-to-end process for a full customer onboarding process, compliant with European regulatory expectations, including manual controls within a 5-minute (24/7) SLA.

General information

How it works

ID document capture

The user is fully guided to achieve a successful capture of their identity document thanks to photo and video capture tools.Checking of the document

The fully automated service verifies the authenticity of the document.Checking of the holder

The identity of the bearer is checked on the basis of facial recognition and liveness detection (added manual processing is also possible).Verdict reception

A clear answer about the legitimacy of the document and the identity of its bearer is delivered, along with a downloadable detailed report.

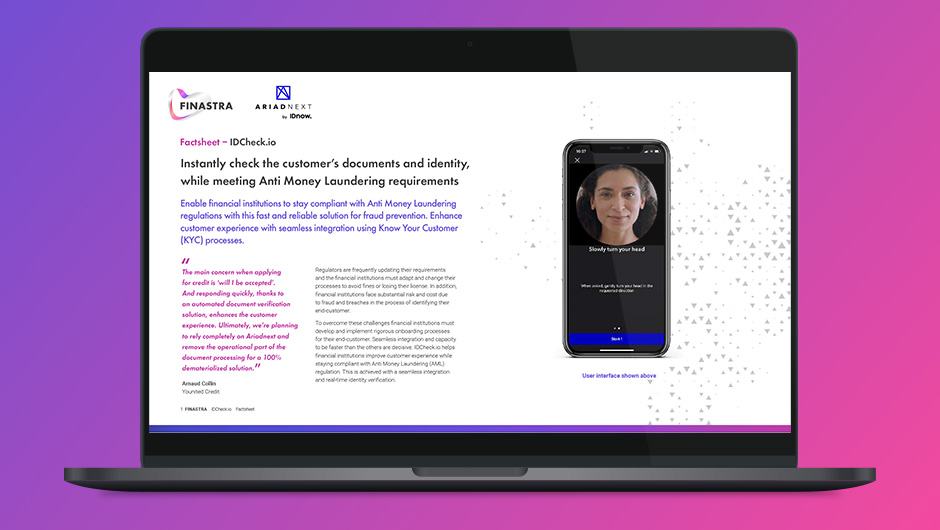

How it looks

Face match and liveness verification

The application compares the photo on the document provided with the video selfie of the customer. Liveness detection is performed at the same time. Show lessProfile approved

The onboarding process may be pursued and banks are ensured they are dealing with a real customer! Show less

ID verification

The customer can upload official ID documents Resources